Insurance enables those who suffer a loss or accident to be compensated for the effects of their misfortune. The payments come from a fund of money contributed by all the holders of individual insurance policies. In other words, individual risks are pooled and shared, with each policyholder making a contribution to the common fund. The contribution is known as the

Premium

Premiums are paid to

Insurers

These are institutions which accumulate the money into the fund from which claims are paid. The loss is in fact paid for by the policyholder making the claim and by all the other policyholders who have not suffered in the someway. Insurers are professional risk takers. They know the probability of different types of risk happening. They can calculate the premiums needed to create a fund large enough to cover likely loss payments. Clearly, only a proportion of policyholders will require compensation from the fund at any one time so two important factors arise when calculating the premium.

- The probability for a loss.

- Whether the particular policyholder is above or below average in risk?

Ribha Software Consultancy Services For Insurance Company

INSURANCE APPS DEVELOPMENT

- Online portals

- Document management systems

- Billing and payment solutions

- Claims management software

- Solutions for HR

MOBILE APPS

- Native and hybrid mobile apps

- Push-notifications

- Accident reporting

- GPS tracking

- Payments

- Claims management

INTEGRATION

- Document management systems

- Electronic archive systems

- Financial and accounting data

- Regulatory and legislative documentation

- CRM

Ribha Software Consultancy Services Insurance Software Solutions

-

Online portal / Mobile App

-

User Account

-

Digital Marketing System

-

CMS

-

API

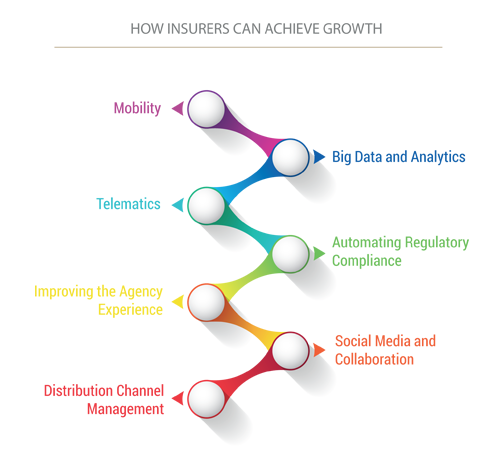

Growth and opportunities

Information Technology Outsourcing (ITO) is the contracting out of IT service to one or more external organization responsible for managing and delivering the required services to the client organization. Although the industry was an early adopters to IT outsourcing (ITO) and offshore models, the fastest growing insurance vertical needs IT services in Business analysis, Premium accounting, Policy owner services, corporate treasury functions, Risk analysis & Management, Data Entry and management, Data warehousing and Loan processing.

Business Process Outsourcing (BPO) is the delegation of one or more IT-intensive business processes to an external provider that, in turn, owns administers and manages the selected processes based on defined and measurable performance criteria. Business Process Outsourcing (BPO) is one of the fastest growing segments of the Information Technology Enabled Services (ITES) industry.

What we offer

- Claims Processing & Adjudication

- Channel Management Analysis for Agents & Brokers

- Early Fraud Detection & Prevention

- Multi channel delivery